August 9, 2024

Optional Count On Wikipedia

Optional Trust Fund Wikipedia In simple terms, the count on will be subject to tax obligation of 6% on the ₤ 263,000 which is ₤ 15,780. The trustee( s) may change over the life of the depend on and it is possible for brand-new and/or replacement trustee( s) to be assigned and for the trustee( s) to be gotten rid of or retired. It was during these land disputes that trust regulation developed, starting out from the legal term "use of land" to the depend on system that we are now acquainted with. Manisha signed up with the Society's Technical Guidance Team in July 2019 having actually previously functioned as an Employment Solicitor in Warwickshire before transferring to Lincolnshire.Jenny Walsh Partnerwills, Probate And Contested Estates

- It is likewise valuable where the beneficiary has a drink, drug or gaming problem and the testator does not wish to gift the monies to them straight for anxiety it could exacerbate their addiction.

- In this circumstance, the charity, as opposed to the grantor, is treated as receiving the circulation, and neither the grantor nor the estate will certainly owe earnings tax obligations on the amount.

- Discover more about just how to provide your youngsters with monetary stability throughout their lifetime.

- The details consisted of in this update is for basic info functions only and is not legal advice, which will depend upon your specific conditions.

Pros And Cons Of Setting Up A Discretionary Trust Fund

Discretionary trusts used to acquire Victorian residential property –… - Maddocks

Discretionary trusts used to acquire Victorian residential property –….

Posted: Wed, 22 Apr 2020 07:00:00 GMT [source]

Extra Technical Assistance

One example is that there is no land tax limit exception for Discretionary Trusts and realty can sometimes be kept in an extra tax reliable way outside of a Depend on framework. We do not handle customer funds or hold protection of possessions, we aid customers get in touch with appropriate monetary experts. This type of trust can be used by settlors that are not going to surrender accessibility to the resources yet want to start IHT preparation by freezing their responsibility on the capital at 40% of the original premium. Although this kind of trust fund offers no IHT benefits for a UK domiciled specific, there are a number of non-tax advantages which make this kind of depend on appealing. It is possible for the settlor to be assigned as the protector of the trust fund. Discretionary trusts do not gain from relief on stamp task, even if the count on is a 'very first time customer'. Instead, an optional depend on will typically be responsible at the higher price of stamp task. It is very important to note that where a main residence passes to a discretionary trust, the RNRB will not use. However, the RNRB might be recovered if the home is designated out to direct descendants within 2 years of the testator's date of fatality due to section 144 of the Inheritance Act 1984. A crucial factor which identifies Discretionary Trusts, however, is that they operate while crucial member of the family are living and can have a say in how they're managed. Dealing with an adviser may come with possible disadvantages such as repayment of costs (which will reduce returns). There are no assurances that collaborating with an advisor will certainly generate positive returns. Because of the complexity of trust funds, it's always suggested to look for expert specialist advice prior to establishing a trust. The entrance cost is also referred to as the lifetime charge or immediate charge and is assessed when the trust is developed. Presents into optional trust are classified as chargeable life time transfers (CLTs). When setting up a new trust fund you have to take into consideration any type of previous CLTs (e.g. presents into discretionary counts on) made within the last 7 years. As long as this total amount does not surpass the settlor's nil price band (NRB) there will be no entrance cost. If it is a pair who are establishing the count on you increase up the nil price band.What are the features of an optional trust fund?

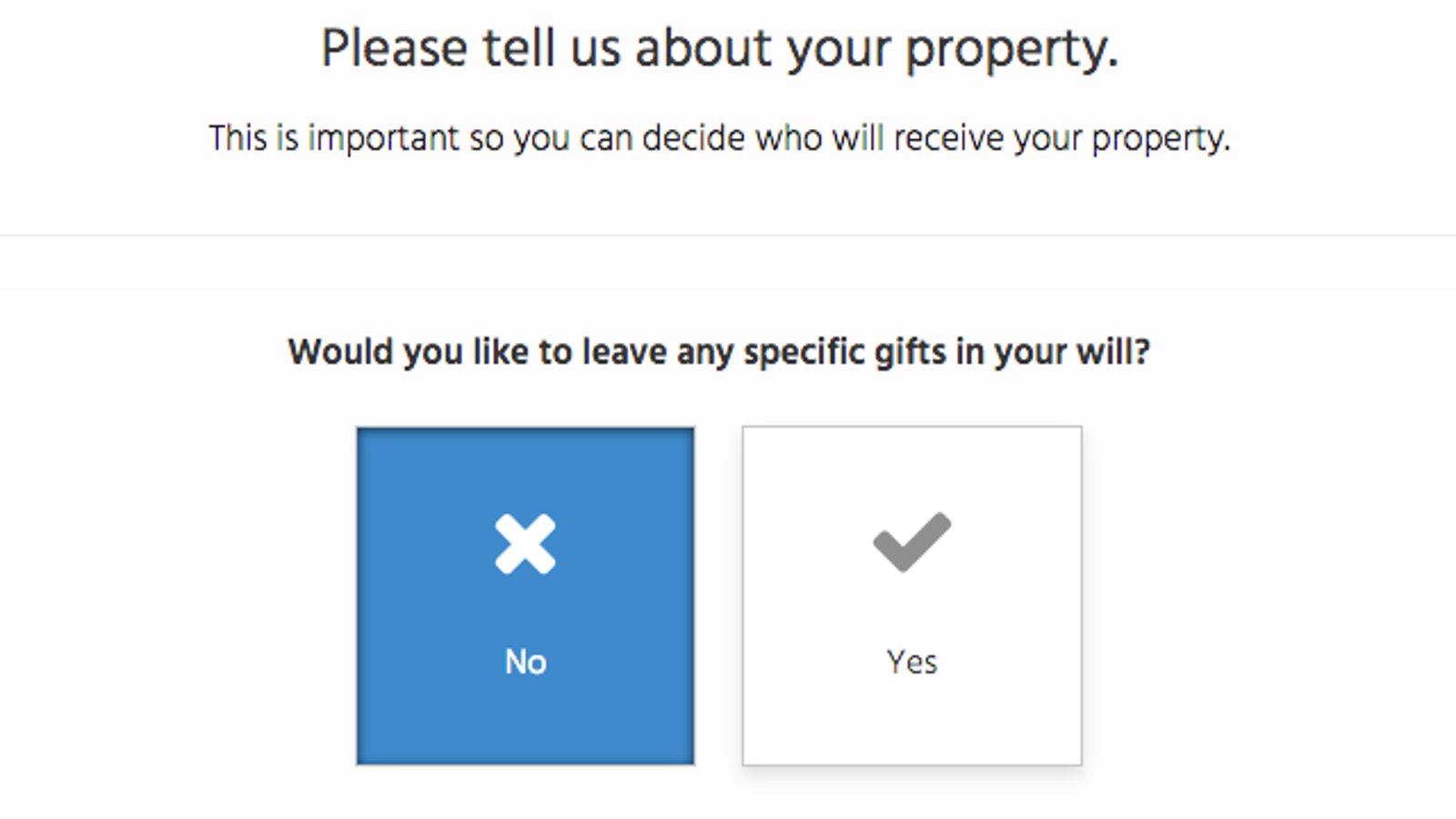

- one or two individuals who are the principal recipients, the loved ones of the primary recipients, companies had by the major beneficiaries and their family members; and.the circulation of capital and earnings to the recipients is at the discernment of the trustee. Optional counts on are in some cases set up to place properties apart for: a future requirement, like a grandchild who might need a lot more monetary help than various other beneficiaries at some point in their life. recipients who are not qualified or accountable adequate to deal with money themselves. 1. Just calling a solitary beneficiary.

Social Links