August 19, 2024

Seven Different Sorts Of Wills For Seniors

Seven Various Types Of Wills For Elders Use of a Wipeout Clause lets you call several "wipeout recipients" that would certainly acquire your estate in a scenario like the one defined above. In this instance, the federal government can treat your estate as if you didn't leave a Last Will, which is additionally known as dying intestate. If this occurs, the government might disperse your estate in a manner you would certainly not have actually approved of when you lived.The Risks Of Do-it-yourself Wills In New York

- Holographic wills are simple despite their difficult name.

- Furthermore, while inheritance tax are paid straight from the estate itself, estate tax are paid by the heir or recipients based on what they got in probate.

- If you're under 50 years old and if your assets (right stuff you own) aren't worth sufficient to get struck with estate taxes, then a simple will certainly functions just great.

- Then, prior to they maturate, you can designate a legal guardian in their location.

- Note that you do not have to be a single person to make a very easy will.

- On the other hand, a nuncupative will or an oral will is just valid in some jurisdictions.

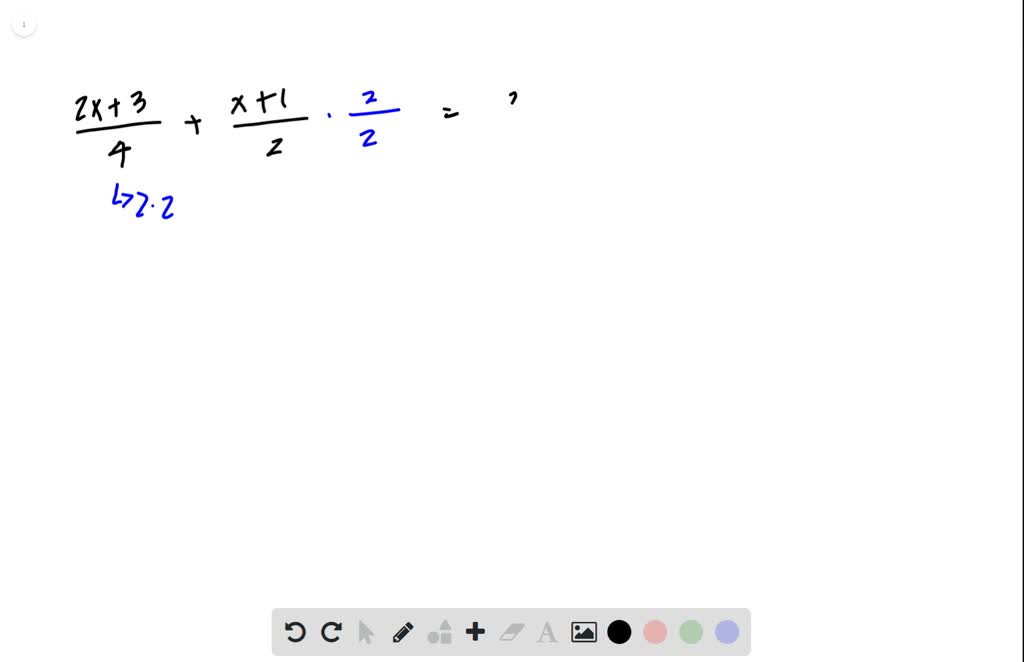

What Is the 1040 Tax Form? How to Fill It Out - NerdWallet

What Is the 1040 Tax Form? How to Fill It Out.

Posted: Fri, 05 Jan 2024 08:00:00 GMT [source]

Why You Can Trust Us

A will certainly is a legal document in which you share your choices for distributing your assets and the care of any small youngsters. In addition, your beneficiaries might have to invest even more time, cash, and emotional power to settle your affairs when you're gone. This is at the opposite end of the range to preparing your Will making use of an empty kind kit. This strategy gives you the chance to obtain legal recommendations if you have uncertainties regarding your scenario. You might additionally obtain some tax preparation suggestions and basic information regarding "estate preparation". Wills are necessary to ensure that a person's assets will certainly be properly dispersed and not most likely to various other, probably unwanted, celebrations." Uslegalwillscom Is A Much More Budget-friendly Alternative For Young Professionals Or Those With Little Ones"

When producing a will certainly on one's own, it is incredibly usual to make use of incorrect terminology, several of which might cause questions about the person's actual intent to disperse properties. An estate may be reopened under specific situations, including the existence of newly uncovered property. The chosen Clerk of Superior Court in each area acts as the probate court in North Carolina. Elected staffs and their assistant staffs hold most estate hearings and commands many estate situations. If the validity of a will is tested in a caveat proceeding, the caveat case will be listened to by a Superior Court judge. Nothing, if you type it up yourself utilizing a cost-free online layout and your state does not need that it be notarized. Yet, if Codicil you're afraid that you'll make a mistake that would certainly make your will certainly unclear or invalid-- or if you simply feel confused or overloaded by the process-- consider upgrading to a paid alternative. Leave them to somebody you depend take excellent treatment of them or locate them a loving brand-new home. Likewise take into consideration leaving this caretaker adequate money to care for your family pet, particularly if your friend needs a special diet regimen, drug, or frequent veterinary care. Also if you have pet insurance coverage, the plan may not move to a new proprietor. You'll additionally name beneficiaries and alternates to receive specific assets. Any kind of property you consisted of in the count on will once again be countable and can be spent for your wife's treatment until she comes to be qualified for Medicaid benefits. Handwritten, unwitnessed wills (called "holographic wills" in lawful terms) are legal only in some states, so you're running into harmful area. Also if your state recognizes holographic wills, these kinds of wills open themselves up to even more challenges. If your state permits transcribed, unwitnessed wills, at the minimum, see to it your transcribed will is signed. The terms of joint wills-- including administrator, recipients, and various other stipulations-- can not alter even after the death of one testator. Due to this inflexibility, joint wills can end up being troublesome for making it through partners that want to alter their estate strategies. No one likes to think about their death, so creating a will could've been something you have actually been delaying. However the truth is, it's a fairly simple procedure that will just take a couple of hours tops and will give you comfort recognizing you've put down your last desires. Keep reading to find out just how to create a simple will certainly that will cover many basic economic situations and be valid under United States regulation. You'll likewise learn about various services you can make use of if the idea of writing your very own will certainly from square one makes you also anxious. A simple will certainly is a legal record that outlines what you wish to happen to your things when you die. Assets kept in count on aren't based on probate the way they would be with an easy or complicated will. Power of attorney (POA) describes the authority you offer somebody else to decriminalize, monetary, or clinical decisions in your place. These records are commonly consisted of in online estate preparation solution packages. Letters testamentary and letters of administration are lawful documents issued by the clerk of court that give a person authority to work as the individual rep of the estate These "letters" will frequently be asked for by organizations such as financial institutions or insurer during estate management. There are normally two fundamental types of letters, based upon whether the estate is testate (with a will) or intestate (without a will). You might likewise incur extra costs each time you make an update to your will. Your will must establish an executor and trustee that will manage your events after you die. Their responsibility is to carry out the wishes laid out in your will, disperse funds to your recipients, and act on part of your company and economic rate of interests when you pass away. You should also include several backup executors in situation the key administrator is unable or resistant to act in this function. Your will certainly ought to describe the possessions, residential or commercial properties, belongings, and money that will be dispersed per of your beneficiaries. It must likewise consist of a clause that outlines what takes place if a beneficiary passes away before you and exactly how their possessions will be distributed.What is a simple will in California?

evaluated and thought about. An executor can likewise be a person you've named as a recipient in your will. The function of an executor is a severe one which lugs a lot of obligation.

Social Links